Family budgeting is a major part of everyday life, and is often the difference between financial success and failure. While it may seem like a daunting task, the right budgeting app can make it easier to plan, track and manage your family’s finances, and help you stay on track with saving and spending goals.

With so many budgeting apps on the market today, it can be difficult to decide which one is best for you. Before making your decision, here are 9 things you need to know about family budget apps.

Things to know:

1. Set Realistic Budgets–

Before you start using a budgeting app, make sure you set realistic budgeting goals for your family. Think about how much money your family makes each month and decide how much you can realistically spend in each category. Setting realistic budgets helps you stick to them and ensures a better chance of achieving your financial goals.

2. Track Spending–

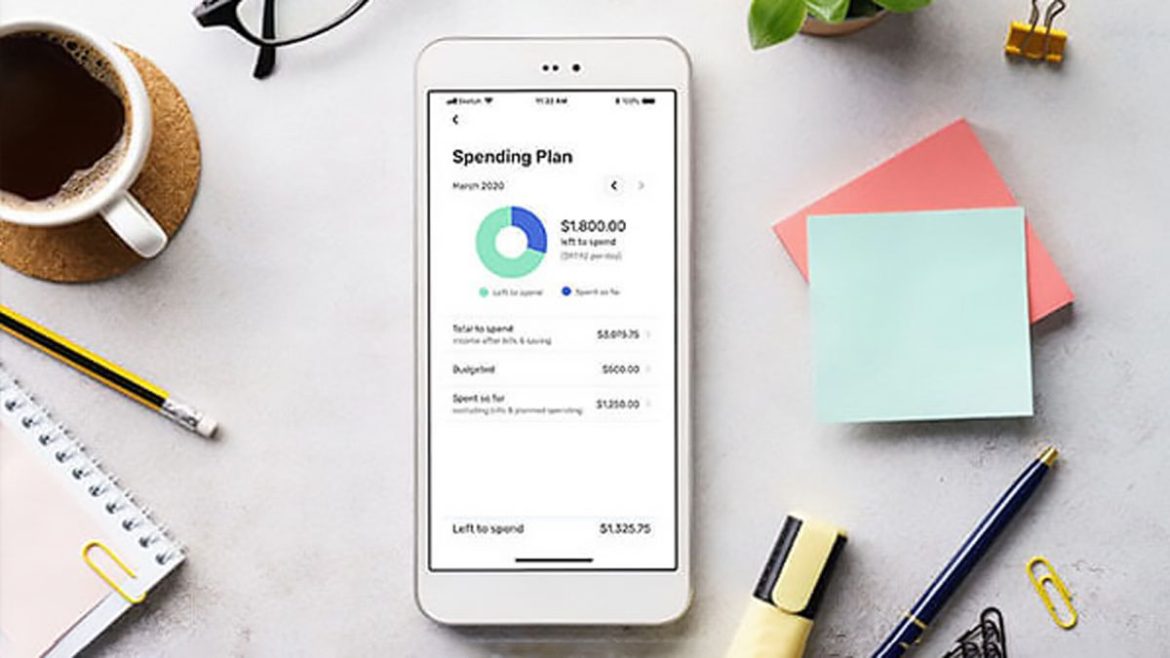

One of the most important things a budgeting app can do is help you track your spending. This is important for understanding where your money is going and enables you to adjust your budget accordingly. Make sure the budgeting app you choose has features that let you easily track and categorize your spending.

3. Track Debts–

Many budgeting apps also give you the ability to track any debts you may have, such as loans, credit cards, and more. This gives you an overview of what debts you owe and lets you prioritize payments. It’s important to understand how debt repayment works so you know when and how much you should be paying each month.

4. Streamline Savings–

A family budgeting app can also help streamline your savings goals. Some apps include features like automatic deposits so you don’t have to worry about manually transferring money each month. This can help you keep up with your saving goals while also making sure your bills are paid on time.

5. Set Goals–

Most budgeting apps allow you to set and track financial goals. This can include saving money for retirement, a vacation, or a major purchase. It’s important to set goals that are specific and achievable in order to stay on track and make sure you’re on the right path.

6. Automate Your Finances–

Automating your finances is a great way to save time, maintain control, and save money. Many budgeting apps automatically sync with your bank accounts, categorize transactions and enter expenses into their budget software. Automation can also help you stick to a budget, as it eliminates the need for manual entries and simplifies the budgeting process.

7. Monitor Progress–

Monitoring your progress is a great way to stay motivated and accountable to your budget. Most budgeting apps will allow you to set reminders and even visualize your progress with charts and graphs. This can help remind you of your long-term goals and make it easier to adjust your budget when needed.

8. Multiple Users–

If you have multiple users in your family, make sure the budgeting app you choose has features that let multiple users access the same account and view different information. Some apps also allow you to set different financial goals for each user.

9. Choose the Right App–

There are many family expense tracker available, but not all of them have the same features. Make sure you choose an app that has the features you need to manage your family’s finances, such as budgeting tools, debt tracking, savings goals, and more.

When it comes to budgeting apps, looks can be deceiving. It’s important to research and compare different products before making a decision to ensure the app you choose meets the needs of your family. By understanding the essential features of family budgeting apps and knowing what to look for in a product, you can make an informed decision and choose the best app for you.